The following is from Gallup News.

WASHINGTON, D.C. — Amid turbulence in the U.S. banking system, nearly half of Americans are anxious about the safety of the money they have in accounts at banks or other financial institutions.

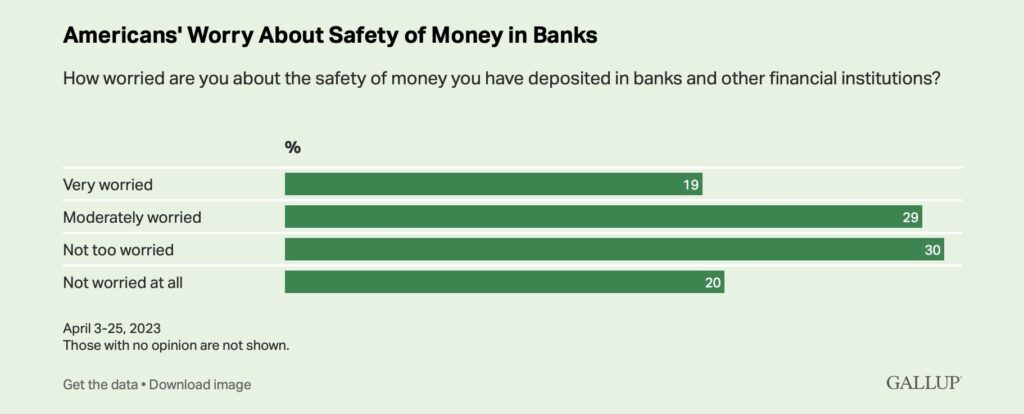

A total of 48% of U.S. adults say they are concerned about their money, including 19% who are “very” and 29% who are “moderately” worried.

At the same time, 30% are “not too worried” and 20% are “not worried at all.”

These findings are from a Gallup poll conducted April 3-25, the month after Silicon Valley Bank and Signature Bank collapsed.

News about the failure of a third bank — First Republic — came after the poll was completed. Most bank failures in the U.S. over the past two decades have been linked to the 2008 financial crisis, which was the last time Gallup gauged Americans’ level of worry about their money held in banks or other financial institutions.

The latest readings are similar to those in 2008.

In September of that year, shortly after the collapse of Lehman Brothers, which remains the largest bankruptcy filing in U.S. history, 45% of U.S. adults said they were very or moderately worried about the safety of their money.

Several months later, in December, after Congress’ Troubled Assets Relief Program (TARP) bailed out other banks in danger of failing, Americans were slightly less concerned about the safety of their personal financial accounts, as 41% said they were very or moderately worried.

Read complete polling results here.

Visit The Sharyl Attkisson Store today

Unique gifts for independent thinkers

Proceeds benefit independent journalism