State treasurer compiles list of 13 financial institutions that could be banned from doing business with state entities

Oklahoma became the latest state to take action against Wall Street firms that it claims are hurting companies that are essential to providing jobs and energy for the state.

Oklahoma Treasurer Todd Russ announced on Wednesday that 13 financial institutions, which have been deemed to be discriminating against Oklahoma’s energy industry, will be banned from doing business with the state, losing access to billions of dollars in municipal fees, including managing state pension money, in accordance with a recently passed Oklahoma law.

“We’re definitely a large energy-producing state,” Russ told The Epoch Times. “The [law’s] language is pretty clear, that we don’t intend to support people that are going to work against industries in a state like ours.”

In recent years, many of America’s largest banks and asset managers have championed the Environmental, Social and Governance (ESG) movement, taking action against fossil fuel companies, promoting social-justice causes, and in some cases, denying financial services to disfavored industries like firearms. In May of 2022, Oklahoma Gov. Kevin Stitt signed House Bill 2034, the Energy Discrimination Elimination Act, which requires the state treasurer to deliver to all state entities a list of financial companies that boycott energy companies.

The institutions that Russ placed on the list include BlackRock, Wells Fargo, JPMorgan Chase, Bank of America, State Street, Grosvenor Capital Management, Lexington Partners, FirstMark Fund Partners, LLC, Touchstone VC Global Partners, WCM Investment Management, William Blair, Actis LLP and Climate First Bank. They have all been given an opportunity to respond.

“The energy sector is crucial to Oklahoma’s economy, providing jobs for our residents and helping drive economic growth,” Russ stated. “It is essential for us to work with financial institutions that are focused on free-market principles and not beholden to social goals that override their fiduciary duties.”

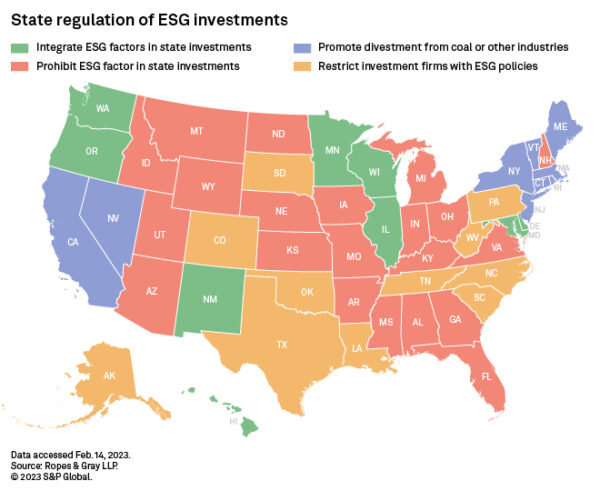

According to a report by Harvard Law School, as of March this year, at least seven states have enacted laws or regulations to bar fund managers from considering ESG factors when investing state money. At least eight states have enacted laws to prevent their state from doing business with companies that discriminate against industries considered “disfavored” by the ESG movement, and three states have done both. Conversely, two states, Illinois and Maryland, have enacted laws that require ESG considerations when investing their state pension and other funds, and six states have laws or regulations that ban investments in ESG-disfavored industries.

Noting that asset managers like BlackRock, the world’s largest with approximately $9 trillion under management, control significantly more money than the billions that states have to invest, some analysts warn that conservative states will pay a heavy financial price for taking on Wall Street. But according to Derek Kreifels, CEO of the State Financial Officers Foundation, which includes 28 states, the cumulative money held by states that do not favor the ESG movement is nearly $3 trillion.

This is a significant step by Treasurer Russ in guarding his state’s financial security against ESG advocates like BlackRock and State Street and other financial institutions that boycott energy companies and prioritize agendas that run contrary to Oklahoma taxpayers’ interests,” Kreifels said. “Treasurer Russ and state financial officers across the country are at the forefront of the fight against ESG, ensuring that American families’ savings are invested according to their values and not ESG extremists.”

“These are mega money managers, dealing with hundreds of billions or trillions of dollars, so the amount of punch that you’ve got to put into communicating economically with managers like BlackRock and JPMorgan and State Street has got to be pretty significant to get their attention,” Russ said.

“State governments are the ones that hold these pools of money in the billions of dollars, so it’s really up to us to try to address this, especially if we pull together cohesively to stand up for what’s best for America, and what’s best for the states that produce the energy that keeps America going.”

On March 16, Oklahoma Gov. Kevin Stitt issued a joint statement with 18 other governors, protesting a new Biden administration policy that allows pension funds to consider ESG issues when investing peoples’ pension money, under the Employee Retirement Income Security Act (ERISA). Previously under ERISA, federal guidance had been that fund managers may invest retirees’ money solely to general the highest financial return.