Full story: ‘Not the Brexit I wanted’, says Next boss

Kalyeena Makortoff

Simon Wolfson, the chief executive of clothing and homeware retail Next has urged the government to make it easier to allow foreign workers into the UK and said this is “not the Brexit I wanted”.

The Conservative peer and Brexit supporter said the government was blocking much-needed workers from entering the UK, even though firms were desperate for labour.

“We have got people queueing up to come to this country to pick crops that are rotting in fields, to work in warehouses that otherwise wouldn’t be operable, and we’re not letting them in,” Lord Wolfson said in an interview with the BBC.

He said:

In respect of immigration, it’s definitely not the Brexit that I wanted, or indeed, many of people who voted Brexit wanted.

Businesses across the UK have been struggling to find staff, partly due to Brexit restrictions that meant EU citizens no longer had the right to work in the UK. It has affected hospitals, pubs, restaurants and logistics firms, and last year the government was forced to offer temporary visas to lorry drivers and poultry workers to help fix the resulting supply chain crisis.

Wolfson said most people in the UK had a “very pragmatic view” of immigration and urged the government to take a “different approach to economically productive migration”.

“Yes, control it, where it’s damaging to society, but let people in who can contribute,” the Next chief executive added.

More here:

Key events

Filters BETA

UK wholesale gas prices more than doubled last week.

The System Average Price (SAP) of gas rose by 110% in the week to 6 November 2022, the Office for National Statistics reports. That’s the largest week-on-week increase this year.

It pushed gas prices to more than triple their levels in February 2020. However, they were still 80% below the peak in August 2022, when European gas prices soared as countries raced to fill storage tanks before winter.

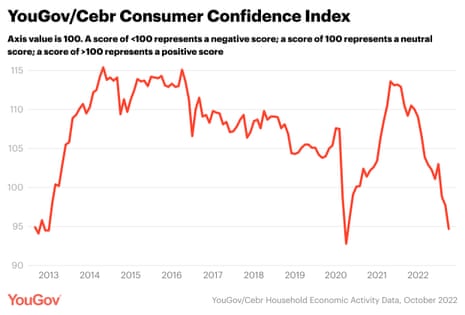

Consumer confidence at lowest point since first Covid lockdowns

Consumer confidence has tumbled to its lowest point since the early days of the COVID-19 pandemic, after the mini-budget hammered optimism.

The latest consumer confidence report from YouGov and Cebr has found that people are the most pessimistic since the first lockdowns in April 2020.

Optimism about the economic outlook, and the outlook for house prices, both fell, and people remain very gloomy about their household finances.

Here are the key points:

-

Consumer confidence declines (-3.0) to its lowest score (94.7) since April 2020

-

Confidence in short-term house prices (-9.4) and outlook (-11.3) plunges

-

Retrospective (-1.2) and forward-looking (-2.5) business activity metrics fall

-

Optimism around household finances improves (+2.5) but remains negative (45.5)

Josie Dent, managing economist at Cebr explains:

“Consumer sentiment suffered yet another decline in October as the fall-out from the so-called ‘mini budget’ compounded ongoing worries about the cost-of-living crisis.

A set of unfunded tax cuts announced by the then-Chancellor Kwasi Kwarteng sent financial markets into turmoil and caused mortgage rates to skyrocket, prompting speculation about a substantial price correction in the housing market in the months ahead. It is therefore unsurprising to see the backward- and forward-looking indicators on home values reporting the largest falls this month.

Declines in the business activity indicators and ongoing pessimism regarding household finances have also contributed to the 14.5-point year-on-year drop in the headline YouGov/Cebr Confidence Index this month, the largest annual fall since 2011.”

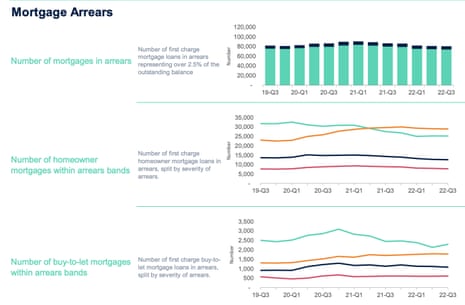

Home repossessions jumped in last quarter

The number of UK homes being repossessed jumped in the third quarter of this year, as some households and buy-to-let landlords were unable to pay their mortgages.

Trade body UK Finance has reported that 700 homeowner mortgaged properties were taken into possession in the third quarter of 2022. That is a 15% increase on the previous quarter, although still below pre-pandemic levels.

An additional 390 buy-to-let mortgaged properties were taken into possession as well in July-September, an 11% increase.

Mortgage rates had climbed this year, even before the mini-budget in late September, as the Bank of England raised borrowing costs to fight inflation.

Karen Noye, mortgage expert at Quilter, says the process of a lender repossessing someone’s home due to missed payments has started to increase “at a significant rate” although levels still remain below pre-covid levels.

“Compared to the same quarter in 2021, mortgage possession claims increased from 2,832 to 3,680 (30%), orders from 1,229 to 2,491 (103%), warrants from 947 to 2,437 (157%) and repossessions by county court bailiffs increased from 390 to 744 (91%).

Historically, periods of high interest rates has coincided with an uptick in the number of repossessions due to people’s monthly payments increasing to levels they can no longer pay.

With high energy and food prices some people will start to struggle to heat their homes, eat and service their mortgage and this will lead to repossession.

Tens of thousands of households are struggling to pay their mortgagers, UK Finance’s data shows.

There were 74,440 homeowner mortgages in arrears of 2.5% or more of the outstanding balance in the third quarter of 2022, which includes 28,910 homeowner mortgages with at least 10% of their outstanding balance in arrears.

Chinese banks made much fewer loans last month than forecast, as its economy slowed.

Banks made 615.2bn yuan (£74bn) in new yuan loans in October, down from 2.47 trillion in September, and below the 826.2bn a year earlier.

JUST IN:#China‘s new yuan #loans and total social #financing crashed in October:

China issued 615.2B yuan of new loans , compared with 2470B yuan in Sep.

Social financing was 907.9B yuan, compared with expected 1.6 trillion yuan and the previous 3.53 trillion yuan.

— macropanda (@macro_panda_) November 10, 2022

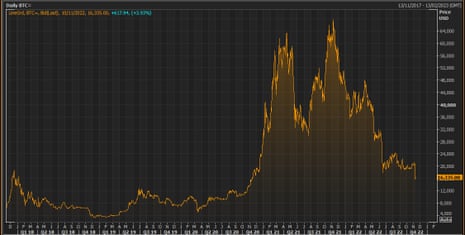

Bitcoin could fall to $13,000 amid FTX crisis

The crisis gripping crypto exchange FTX could wipe another 20% off Bitcoin’s value, JP Morgan analysts say.

They predict a wave of margin calls across the industry, which could send bitcoin down to $13,000, warning:

“It looks likely that a new cascade of margin calls, deleveraging and crypto company/platform failures is starting.”

Such a fall would wipe out all the bitcoin rally that began in November 2020, and peaked in November 2021.

Bitcoin is already down 65% so far this year, to around $16,300, hitting a two-year low overnight after rival Binance abandond plans to rescue FTX.

Pandemic home working and long Covid drive up long-term sickness

Back and neck problems caused by home working during the lockdown, and long Covid, have contributed to the surge in people unable to work due to long-term sickness.

The Office for National Statistics reports that the number of economically inactive people with problems or disabilities connected with the back or neck has risen by 62,000, or 31%, over the last three years.

The biggest year-on-year increase was between 2021 and 2022, after millions of office staff spent many months working from kitchens, attics and spare bedroom.

ONS senior statistician Hugh Stickland said the largest increase was from people with other health problems or disabilities.

“While this category includes people affected by long-Covid, we think that’s only one of several contributing factors.

“The next highest rise was among people with back or neck problems. It’s possible that increased homeworking has given rise to these kinds of conditions.

Overall, the number of working-age adults out of the labour market because of long-term sickness has risen from 2 million in spring 2019 to about 2.5 million in summer 2022.

That 500,000 increase has pushed up economic inactivity, and contributed to the shortage of workers.

Former wholesale and retail workers are the most likely to be economically inactive because of long-term sickness.

Around 2.5 million people were economically inactive because of long-term sickness in summer 2022 – compared with around 2 million people in spring 2019.

Since the #COVID19 pandemic hit the UK, the number of people out of work because of long-term sickness has risen by 363,000. pic.twitter.com/HylYPhKG7K

— Office for National Statistics (ONS) (@ONS) November 10, 2022

With NHS waiting lists at record highs, it’s taking much longer for people to get treatment to help them back to work.

Waiting times for NHS treatment in England have almost doubled, from around 7 weeks in April 2019 to almost 14 weeks in August 2022.

The number of people in England waiting to start hospital treatment rose to 7.1 million at the end of September, up from 4.4 million before the first lockdown in February 2020.

The number of economically inactive people reporting mental illness and nervous disorders has risen 22% since 2019, with the sharpest increases seen after 2020.

But the number citing depression, bad nerves and anxiety as their main health condition has returned to pre-pandemic levels, after increases in 2020 and 2021.

The biggest relative increase in those inactive because of long-term sickness was seen among those aged 25 to 34, at 42%.

Of these, nearly 61% were men.

Increases in those aged 16 to 34 were largely driven by mental illness, phobias and nervous disorders. pic.twitter.com/TZxCC6yM3W

— Office for National Statistics (ONS) (@ONS) November 10, 2022

We also looked at which industries people worked in and what jobs they did in the two years prior to reporting long-term sickness.

Wholesale and retail trade had the most former workers out of work on long-term sick per every 1,000 current workers.

➡️ https://t.co/8xREKUkLtv pic.twitter.com/Rexsn3IQw0

— Office for National Statistics (ONS) (@ONS) November 10, 2022

Full story: ‘Not the Brexit I wanted’, says Next boss

Kalyeena Makortoff

Simon Wolfson, the chief executive of clothing and homeware retail Next has urged the government to make it easier to allow foreign workers into the UK and said this is “not the Brexit I wanted”.

The Conservative peer and Brexit supporter said the government was blocking much-needed workers from entering the UK, even though firms were desperate for labour.

“We have got people queueing up to come to this country to pick crops that are rotting in fields, to work in warehouses that otherwise wouldn’t be operable, and we’re not letting them in,” Lord Wolfson said in an interview with the BBC.

He said:

In respect of immigration, it’s definitely not the Brexit that I wanted, or indeed, many of people who voted Brexit wanted.

Businesses across the UK have been struggling to find staff, partly due to Brexit restrictions that meant EU citizens no longer had the right to work in the UK. It has affected hospitals, pubs, restaurants and logistics firms, and last year the government was forced to offer temporary visas to lorry drivers and poultry workers to help fix the resulting supply chain crisis.

Wolfson said most people in the UK had a “very pragmatic view” of immigration and urged the government to take a “different approach to economically productive migration”.

“Yes, control it, where it’s damaging to society, but let people in who can contribute,” the Next chief executive added.

More here:

Business has also been strong at discount retailer B&M, as shoppers seek out Christmas bargains.

B&M says trading has been good in the first few weeks of the key Christmas quarter as customers look for savings amid a cost-of-living squeeze.

The group, which sells household goods, food, DIY equipment and toys, has seen a 2.5% rise in like-for-like sales in in the first six weeks of the so called “Golden Quarter”.

The retail group WH Smiths has reinstated its dividend, despite the cost of living squeeze hitting the high street.

WH Smiths has announced a “significant recovery” in performance over the last year, with revenues rising to £1.4bn from £886m the previous year.

The company’s travel division, which runs shops at airports and railway stations, had a strong year as pandemic restrictions were relaxed.

CEO Carl Cowling said:

2022 has been a successful year for WHSmith and we enter the new financial year with the Group in its strongest ever position as a global travel retailer with multiple growth opportunities across the world.

We have opened 98 new stores in the year and we have a pipeline of 150 new stores yet to open across 16 countries and in airports as varied as Los Angeles, Salt Lake City, Brussels, Oslo and Melbourne.

Cost of living crisis puts food banks at ‘breaking point’

The cost of living crisis is driving UK food banks to “breaking point” with almost 1.3m emergency parcels given to people over just six months.

The Trussell Trust charity has said families face record-breaking levels of need, with one in five individuals referred to its network now coming from working households.

Trussell gave out more emergency food parcels during the April to September period than ever before, with 320,000 people turning to food banks for the first time.

Nurses, shop assistants and youth workers are among large numbers of people in low-paid jobs forced for the first time to accept charity food parcels to stay afloat as the cost of living crisis transforms the profile of the typical UK food bank user, my colleague Patrick Butler points out.

More here:

Unions are urging rail bosses to “stand by” their staff, as London Underground workers hold a 24-hour strike that will disrupt travel for millions of commuters in the capital.

The strike is the latest move in a long-running dispute over jobs and pensions.

Most tube lines are fully or partly suspended, meaning overland trains and London buses are overcrowded as people try to get to work.

John Leach, assistant general secretary of the National Union of Rail, Maritime and Transport Workers (RMT), told PA Media outside King’s Cross St Pancras:

My message to TFL now is stand by your staff, listen to your staff, thousands of them are on strike today for the sixth time this year.

They’re losing lots of money, don’t they realise in management there’s a serious problem here? What they need to do is stand with their staff.

The Mayor of London needs to stand up for staff and do a proper finance deal which gives TfL money it needs to keep the capital city moving, and not trade off the staff pension, jobs and their conditions of employment for some bad deal, which is what they have done.

Centrica and National Grid lift profit forecasts amid energy crunch

Energy giant Centrica continues to make strong profits from the high electricity and gas prices that are fuelling the cost of living crisis.

Centrica, which owns British Gas, has announced that profits will be ahead of expectations this year.

Its electricity generation and gas production volumes have remained strong, while its energy trading arm has been busy during Europe’s energy crunch.

Centrica is to funnel spare cash back to shareholders, through a £250m share buyback.

But it also says British Gas’s profits will be lower, due to warm weather in October and the broader inflationary and economic pressures.

Shares in Centrica have jumped over 8%, to the top of the FTSE 100.

National Grid has also lifted its earnings guidance today, after growing its underlying profits by 50% in the first half of the financial year.

Yikes this won’t go down well in a cost of living crisis: two of Britain’s biggest energy companies Centrica and National Grid upgrade profits guidance and Centrica launches a £250mn share buyback. More here: https://t.co/FVptPVobP2

— Nathalie Thomas (@NathalieThomas3) November 10, 2022

UK house prices stall as demand weakens

The UK property market is continuing to weaken, as the jump in mortgage rates put off potential buyers.

Sales and inquiries from buyers both dropped last month, as house price growth grinds to a halt, the Royal Institution of Chartered Surveyors (RICS) has reported.

New buyer enquiries fell sharply in October, RICS says, which is the sixth monthly drop in a row. The number of new listings coming onto the market also fell.

Surveyers across the country now predict that prices will decline over the next year.

Simon Rubinsohn, RICS chief economist, explained:

“The latest feedback to the RICS survey provides further evidence of buyer caution in the face of the sharp rise in mortgage costs.

As a result, the volume of activity is likely to slip back over the coming months and realistic pricing is now much more important to complete a sale.

This slowdown is forcing more people to rent. But with fewer landlords putting properties on the market, rents are expected to be driven higher over the near-term.

Buyers start to prepare for their winter hibernation hoping things will have settled down…ward, come spring. Whilst renters brave the inflation storm, foraging for expensive rental scraps that could be 4% higher next year according to RICS https://t.co/zfjxCLKMjf

— Emma Fildes (@emmafildes) November 10, 2022

Both Nationwide and Halifax have seen a drop in house prices in October.

The turmoil following the disastrous mini-budget hit the jobs market in October, explains Neil Carberry, chief executive of the REC, said:

The economic and political uncertainty of September and October has caused employers to become more cautious in their approach to hiring than during the frenzy of earlier in the year.

Decision-making timelines for permanent hires have extended, for instance.

Economic gloom hits UK jobs market, with fewer foreign workers available

UK firms have cut back on hiring new workers for the first time since the pandemic lockdowns in February 2021, as they struggled to find staff.

Permanent placements dropped in October, the first decline in 20 months, according to the latest UK Report on Jobs from KPMG and REC.

It found that heightened economic uncertainty had led some clients to reassess their recruitment plans.

But candidate shortages also dampened hiring – which backs up Simon Wolfson’s call for more foreign workers to be allowed in.

The report says that the number of candidates available fell again last month, with reruiters pointing to the lack of overseas workers:

The decline in permanent staff availability remained more acute than that seen for temporary labour.

When explaining the latest drop in candidate numbers, recruiters commented that people had become more reluctant to switch or seek out new roles due to concerns around the weaker economic outlook, fewer foreign workers and a low unemployment rate.

The report also found that starting salary inflation slipped to 18-month low, as the jobs market cooled. That might allay the Bank of England’s fears that a wage-price spiral could break out.

Prime minister Rishi Sunak will hope to make progress over another Brexit headache – the Northern Ireland protocol – when he meets his Irish counterpart Micheal Martin today.

The two leaders will meet at a British-Irish Council summit in the north-west of England today, which may be a sign that relations are thawing.

The Protocol allows Northern Ireland to remain within the EU’s single market for goods, creating an effective border between NI and Great Britain. That has led to checks, delays and increased costs for businesses.

London wants a complete rewrite of the protocol that would ditch core elements, and threatened to unilaterally overturn it otherwise.

Rishi Sunak to meet the taoiseach Micheal Martin today in north west England at the British Irish Council. They will talk devolved govt in NI and protocol. Michael Gove also attending along with reps from Scotland, Wales, NI, Isle of Man and Channel Islands.

— Lisa O’Carroll (@lisaocarroll) November 10, 2022

The row caused Northern Ireland’s power-sharing Stormont Assembly to break down this year, as the DUP refused to take part due to its opposition to the Protocol.

Assembly elections could be delayed until next April to give talks between the UK and the EU on the controversial Brexit trade arrangements a chance,

Downing Street said Sunak will say he is “determined” to help restore the power-sharing assembly in Belfast “as soon as possible”.

Lord Wolfson also argues that the government needs to focus its ‘very limited resources’ on the people who most need it during the upcoming recession.

That would be a better use of money than cutting taxes for businesses who are less needy, he argues:

“That’s the people who are going to be cold, and people who are going to be hungry, not businesses that want a break on their taxes.

Corporation tax is due to rise to 25% next April, after the plan to freeze it at 19% was scrapped after the mini-budget imploded.

Next year will be tough in the UK, Lord Wolfson adds (with a recession widely expected).

He told the BBC:

“The interesting thing about a supply side recession is that the seeds of correction are automatically certain. So as demand drops, and factories begin to empty, then prices begin to come down,” he said.

“Next year will be tough but there is no need for a national nervous breakdown,” he added.

Back in September, he predicted a second cost of living crisis next year:

Introduction: Next CEO says “it’s definitely not the Brexit that I wanted”

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Brexit means Brexit, as the prime minister-but-three would once insist. And six years after the referendum, Brexit means UK companies are strugging to hire workers.

It’s so bad that the boss of high street chain Next is calling on the government to allow more foreign workers into the UK, to help address chronic labour shortages that are hurting the economy.

Simon Wolfson, who was one of the most prominent business leaders backing the UK leaving the European Union, now fears the UK’s current immigration policy is crippling economic growth.

In an interview with the BBC, Lord Wolfson said that blocking foreign workers has a considerable cost to the UK economy.

He points out:

“We have got people queuing up to come to this country to pick crops that are rotting in fields, to work in warehouses that otherwise wouldn’t be operable, and we’re not letting them in.

“And we have to take a different approach to economically productive migration.”

Wolfson admits that this is not the Brexit that he – or most people – wanted, saying:

“I think in respect of immigration, it’s definitely not the Brexit that I wanted, or indeed, many of people who voted Brexit, but more importantly, the vast majority of the country,” he said.

“And we have to remember, you know, we’re all stuck in this Brexit argument, we have to remember that what post-Brexit Britain looks like, is not the preserve of those people that voted Brexit, it’s for all of us to decide.”

Back in 2016, Wolfson had a much cheerier view, declaring that “On balance, I think we will be better off out”, and that without radical change the UK was “heading for a long era of low growth”.

But now, the UK is facing its longest recession in decades, while the rise in long-term sickness pushed vacancies to record levels earlier this year.

Next itself has now issued two profit warnings this year, as soaring inflation and the weak pound undermined consumer confidence.

Sectors across the economy are find it hard to recruit, including hospitals, pubs and restaurants, and logistics companies. Last year, lorry drivers and poultry workers were offered temporary UK visas to help fix the supply chain crisis.

Government ministers have previously criticised businesses for hiring staff from overseas on lower salaries, undercutting domestic workers.

Wolfson’s solution? Businesses who need foreign workers should pay a tax of 10% to the government on those salaries – to incentivise them to look at home first.

As he tells the BBC:

“It would automatically mean that businesses never bought someone into the company from outside if they could find someone in the UK.

But if they genuinely can’t, they’ll pay the premium.”

Also coming up today

The cryptocurrency market is in turmoil, as the crisis gripping crypto exchange FTX deepens.

Overnight, rival Binance has backed out of a deal to rescue FTX, citing investigations by US financial regulators and concerns about its business practices.

FTX’s founder, Sam Bankman-Fried, has reportedly told investors that FTX needs funding of up to $8bn after a surge in withdrawal requests from customers.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.

— Binance (@binance) November 9, 2022

Every time a major player in an industry fails, retail consumers will suffer. We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.

— Binance (@binance) November 9, 2022

As regulatory frameworks are developed and as the industry continues to evolve toward greater decentralization, the ecosystem will grow stronger.

— Binance (@binance) November 9, 2022

Investors are bracing for today’s US inflation report, hoping it will show that price pressures cooled last month.

The annual CPI rate of inflation is expected to drop to 8% for October, from 8.2%.

A slowdown in inflation could encourage the US Federal Reserve to slow its interest rate rises.

But as Michael Hewson of CMC Markets explains, core inflation is the key to the Fed’s next moves:

Core prices are the main focus and they accelerated in September, pushing up to a 40 year high of 6.6%, and they’ve been sticky all year.

Markets will be looking for evidence of a slowdown here if the narrative of slowing inflation is to take hold. The rise in the US dollar does offer cause for optimism, given it acts as a brake on higher prices. Today we’ll find out whether core prices are giving any indication of slowing down.

We’ll also hear from Bank of England monetary policy committee member Silvana Tenreyro, who is giving the keynote speech at the Society of Professional Economists Annual Conference.

The agenda

-

8am GMT:: China’s new yuan loans for October

-

1.10pm GMT: Bank of England policymaker Silvana Tenreyro gives keynote speech at the Society of Professional Economists Annual Conference

-

1.30pm GMT: US inflation report for October

-

1.30pm GMT: US weekly jobless report