The following is from Gallup News.

Three in five Americans, 61%, say recent price increases have caused financial hardship for their household, marking a six-percentage-point increase from the last reading in November 2022 and the highest since 2021 when Gallup first tracked this measure.

A relatively steady 15% of U.S. adults say the hardship created by inflation is “severe” and affects their ability to maintain their current standard of living, while 46% say it is “moderate” but does not jeopardize their standard of living.

In November 2021, 45% of U.S. adults indicated they were experiencing financial hardship due to rising prices, and two months later, at the beginning of 2022, hardship was up slightly to 49%.

The U.S. inflation rate increased in the following months and eventually hit a 40-year high of 9.1% in June 2022.

The share of Americans saying inflation was a source of hardship in their lives subsequently grew to 56% in August and remained steady in November.

The current high in U.S. adults’ views of rising prices as a moderate or severe hardship, from an April 3-17 nationally representative web survey using Gallup’s probability-based panel, comes even as the inflation rate hit its lowest point in about two years.

This may suggest that the cumulative effects of high prices over the past two years have taken a toll on consumers.

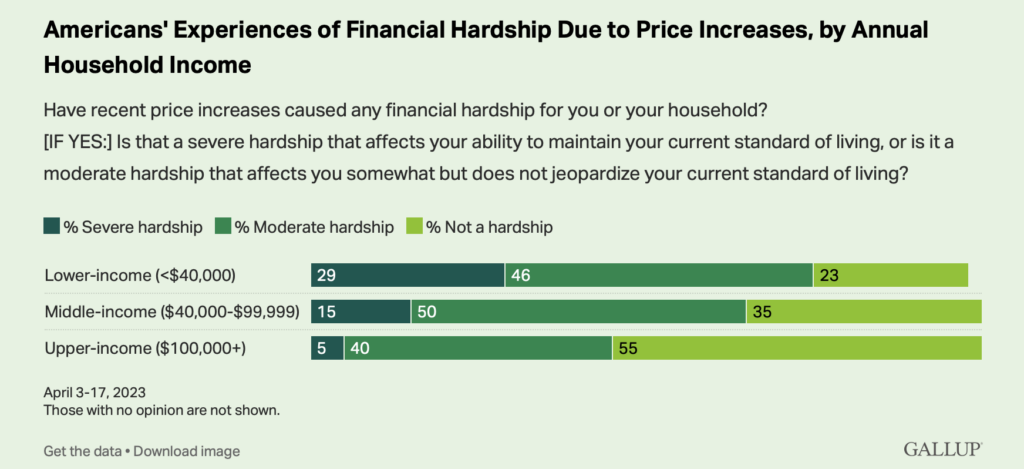

As has been the case for the past two years, lower-income Americans report greater hardship from inflation than those in higher income brackets. Three-quarters of U.S. adults with an annual household income under $40,000 currently say rising prices are causing them at least moderate hardship, including 29% who say it is severe.

Meanwhile, 65% of middle-income adults consider inflation to be a hardship, with 15% saying it is severe. At the same time, less than half of upper-income adults, 45%, say price increases have created hardship for them.

Inflation Far Outpaces Americans’ Other Personal Financial Problems

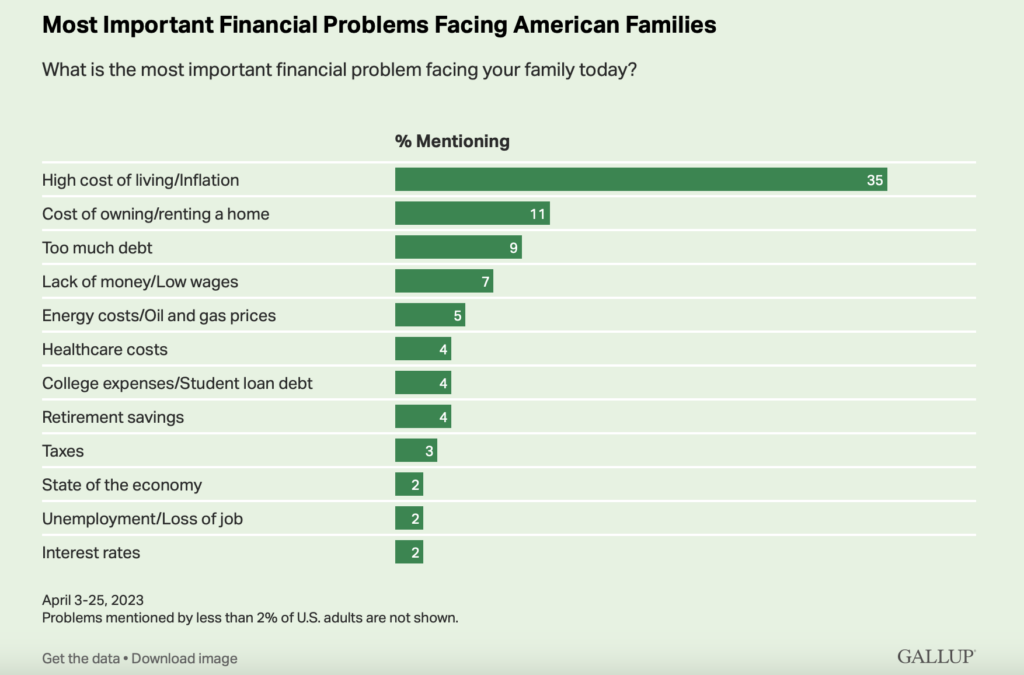

A separate Gallup poll, conducted by telephone April 3-25, finds inflation is by far the top trouble mentioned when Americans are asked to name the most important financial problem facing their family.

The cost of owning or renting a home (11%) ranks a distant second to inflation, while having too much debt (9%) and a lack of money or low wages (7%) follow close behind.

Energy costs, which was second to inflation last year amid high gas prices, has dropped to 5% as gas prices have fallen.

Read complete polling results here.

Visit The Sharyl Attkisson Store today

Unique gifts for independent thinkers

Proceeds benefit independent journalism