OBR: Eight years of living standards growth wiped out in 7% fall

As Hunt sat down, the Office for Budget Responsibility released its latest economic and fiscal outlook.

It’s grim.

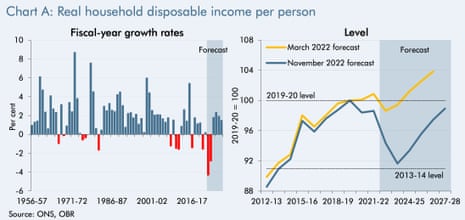

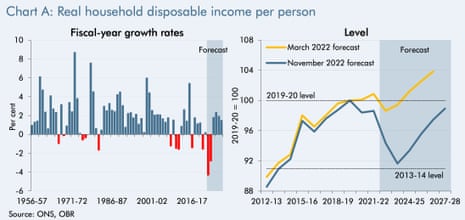

The OBR says that despite the new support with energy bills, living standards are going to fall by 7% over the next two years.

That’s a dire outcome, wiping out eight years of growth.

The OBR says:

Over £100bn of additional fiscal support over the next two years cushions the blow of higher energy prices – but the economy still falls into recession and living standards fall 7% over two years, wiping out eight years’ growth.

Over the medium term, around £40bn in tax rises and spending cuts – in roughly equal measure – offsets higher debt interest and welfare costs and gets debt falling as a share of GDP.

The fall in living standards next year will be the biggest on record, so since at least the mid-1950s, the OBR adds:

On a fiscal year basis, RHDI per person (a measure of living standards) falls by 4.3% in 2022-23, which would be the largest since ONS records began in 1956-57.

That is followed by the second largest fall in 2023-24 at 2.8%.

This would be only the third time since 1956-57 that RHDI per person has fallen for two consecutive fiscal years – the last time this happened was in the aftermath of the global financial crisis.

This chart shows the scale of the hit to living standards, as inflation hammers households.

Key events

-

Fiscal drag means it’s a boiled-frog budget

-

OBR says government debt interest spending up to highest level since just after second world war

-

House prices to fall 9%, OBR predicts

-

Bulb bailout cost hits £6.5bn

-

Unemployment to rise by 505,000

-

What autumn statement means for climate crisis challenge – analysis

-

Tories have forced economy into ‘doom loop’, Labour’s Rachel Reeves tells MPs

-

OBR: national debt will be £400bn higher than expected

-

OBR: recession to last just over a year

-

OBR: Eight years of living standards growth wiped out in 7% fall

-

Hunt confirms benefits and pensions rising by 10.1% next year, in line with inflation

-

National live wage to rise by 9.7% next year, Hunt says

-

Rent rises in social rented sector to be capped at 7%, Hunt says

-

Hunt says energy price guarantee to be extended, with unit prices capped so average bills are no more than £3,000

-

Hunt says government committed to building Sizewell C nuclear power plant

-

Hunt says he is raising NHS budget by £3.3bn over two years

-

Electricity generator shares fall on windfall tax

-

Hunt announces more money for the NHS but says former Labour health secretary will find ‘efficiency savings’

-

Hunt announces £2.3bn extra spending on schools

-

Hunt: this is a £55bn consolidation package

-

Hunt says government departments must make savings to compensate for inflation

-

Hunt says extending windfall tax on energy firms will raise extra £14bn

-

Underlying debt/GDP to peak in 2025-26

-

Hunt confirms 45% rate of income tax to start at 125,000; tax allowance and threshold being further frozen

-

UK now in recession

-

Hunt says his plans will involve ‘substantial tax increase’

-

Hunt says OBR expects inflation to be 9.1% this year and 7.4% next year

-

Hunt praises Bank of England for doing ‘outstanding job’ in tackling inflation

-

Jeremy Hunt starts autumn statement by stressing there are ‘unprecedented global headwinds’

-

Jeremy Hunt to unveil autumn statement

-

Support for Brexit at lowest level since vote to leave in 2016, poll suggests

-

Jeremy Hunt to unveil autumn statement as Labour says ’12 years of Tory economic failure’ holding UK back

Filters BETA

Fiscal drag means it’s a boiled-frog budget

Hunt has delivered “a budget that boils the frog”, says Genevieve Morris, head of tax at Blick Rothenberg.

That’s because the decision to freeze tax thresholds, rather than lift them in line with inflation, means millions of people will pay more tax due to “fiscal drag”.

Morris says:

The continued freezing of tax thresholds means most people won’t notice it directly as the temperature increases, and so won’t leap out of the water.

They’ll simply discover years down the line that they boiled.

Smaller companies are also getting the scalded-amphibian treatment, because Hunt froze the VAT registration threshold at its current level until March 2026.

Martin McTague, chair of the Federation of Small Businesses, has criticised Hunt’s announcement, saying:

“Today’s Budget is high on stealth-creation and low on wealth-creation, piling more pressure on the UK’s 5.5 million small businesses, their employees and customers.

He adds:

Stealthily freezing the VAT threshold at a time of sky-high inflation will both drag more struggling small firms into scope for the tax, while disincentivising others from growing.

FSB’s research shows one-in-four (24%) of small firms and the self-employed are held back by the VAT threshold.

McTague also warns that Hunt has pushed up the cost of employing people – at a time when unemployment is already expected to rise by 505,000:

Freezing the threshold for employer national insurance at a time of such high inflation is a stealthy hike in the jobs tax, just as recessionary pressures threaten an increase in unemployment.

Alongside the understandable rise in the Living Wage, this budget will ramp up the costs of employment without offsetting that with measures to reduce other business costs

Six weeks ago, when Kwasi Kwarteng presented the mini-budget, the government was being run by Laffer curve fundamentalists who believed that cutting taxes would not only generate higher rates of growth, but also increase Treasury revenues. My colleague Peter Walker has been listening to the responses to the autumn statement, and he says nothing has been heard from that faction of the Conservative party in the chamber. Theresa Villiers came closest to endorsing Trussonomics, he says.

Tory MP Theresa Villiers asks Hunt:

“If current forecasts about economic recovery & inflation prove to be overly pessimistic, can we move more quickly than he has announced today towards delivering a lower-tax economy?”2 hours in, that’s as close to Trussonomics as we’ve heard

— Peter Walker (@peterwalker99) November 17, 2022

OBR says government debt interest spending up to highest level since just after second world war

As Paul Johnson, the head of the Institute for Fiscal Studies thinktank points out, the figures in the Office for Budget Responsibility report show that the reason why the chancellor is needing to cut spending and put up taxes so drastically is because the cost of government debt interest – the amount it has to pay to service its borrowing – has gone up enormously this year.

Possibly most important chart in today’s documents. Interest spending going through the roof. Responsible for most of the deterioration in public finances. High interest rates, high borrowing, high inflation, and huge amounts of debt held by Bank of England, cost us very dear pic.twitter.com/Shmisx8HUZ

— Paul Johnson (@PJTheEconomist) November 17, 2022

The

Here are the £ billion numbers. Simply huge. To repeat. The increase in debt increase spending forecasts is responsible for the greater part of the additional fiscal problem we face.

Spending more on debt interest than on any public service bar the NHS pic.twitter.com/O26HkU1ljP

— Paul Johnson (@PJTheEconomist) November 17, 2022

Referring to the graph in Johnson’s first tweet, the OBR says:

Debt interest spending (net of asset purchase facility, or APF, flows) more than doubles in cash terms from £56.4bn (2.4 per cent of GDP) last year to peak at £120.4bn this year (4.8 per cent of GDP), the highest since immediately following the second world war both as a share of GDP and as a share of revenue (12.0 per cent).

Johnson says this explains the background to the autumn statement.

ChX hasn’t cut spending over next couple of years. Pencils in tight spending totals after election. Tax increases mostly on the rich, employers, and energy companies.

Huge increases in debt interest spending.

Couldn’t find a way to get to current budget balance even 5 years out

— Paul Johnson (@PJTheEconomist) November 17, 2022

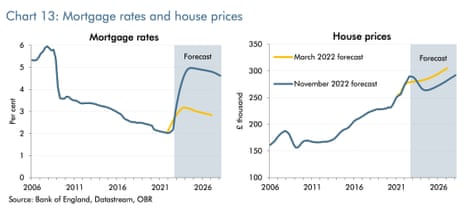

House prices to fall 9%, OBR predicts

UK house prices are expected to have fallen by 9% in two years’ time.

The Office for Budget Responsibility predicts that the jump in mortgage rates will cool the market, while the recession will also hit demand.

The OBR says:

House prices are forecast to fall by 9.0% between the fourth quarter of 2022 and the third quarter of 2024, largely driven by significantly higher mortgage rates as well as the wider economic downturn

That means the house price correction will be well under way when the next election could be taking place in 2024.

Prices are then expected to recover slowly, and “remain below their current level for the next five years”, the OBR adds:

Both Nationwide and Halifax have reported that house prices fell in October, as the mini-budget spooked buyers.

Looking further ahead, property agent Emma Fildes of Brickweaver predicts a jump in sales in 2025, when Jeremy Hunt has announced the stamp duty cuts from the mini-budget will end.

Expect an increase in UK property sales between Jan-March 2025 as buyers look to make the most of the stamp duty saving before it is removed #AutumnStatement #stampduty

— Emma Fildes (@emmafildes) November 17, 2022

Stamp Duty cuts announced in the Growth Plan will now be time-limited, ending on 31 March 2025.

This is to help the jobs & firms that rely on the housing market through the current challenges, while strengthening the public finances in the longer term. #AutumnStatement pic.twitter.com/2obTqRjqvo

— HM Treasury (@hmtreasury) November 17, 2022

Bulb bailout cost hits £6.5bn

Alex Lawson

The cost of bailing out failed energy supplier Bulb has ballooned to £6.5bn, it has emerged.

Documents released alongside the autumn statement show that £4.6bn will be spent on handling the company in 2022-23. In March, the Office for Budget Responsibility said the rescue would cost £2.2bn over two years.

Bulb, which has around 1.5 million customers, collapsed in November last year and was put into a special government-handled administration.

The government has faced criticism for not allowing the company to buy power ahead, exposing it to volatile gas prices.

Bulb was bought by rival Octopus Energy late last month in a deal that founder Greg Jackson vowed would be a “fair deal” for taxpayers.

However, it is still awaiting court approval after rival suppliers complained over a lack of transparency over the terms of the acquisition.

More bad news for workers – real wages are expected to shrink this year, and next year.

The OBR warns that strong nominal earnings growth will be wiped out by high inflation.

So real wages (ie, adjusted for rising prices) as expected to shrink by 1.8% this year, and by another 2.2% in 2023.

The last time real wages fell for two consecutive years was following the financial crisis, when real wages fell for six consecutive years from 2007 to 2013.

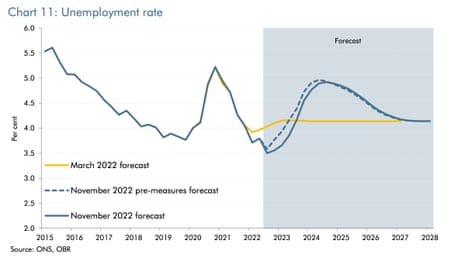

Unemployment to rise by 505,000

Unemployment is set to rise by more than half a million, as the UK falls into recession.

The OBR predicts that the jobless total will rise by 505,000 from 1.2 million at present to 1.7 million at its peak.

The fiscal watchdog says:

We expect the rise in unemployment to lag the fall in GDP as vacancies are likely to fall first before workers are laid off.

What autumn statement means for climate crisis challenge – analysis

Damian Carrington

Ramping up energy efficiency is a no-brainer when it comes to cutting energy bills, ensuring security of supply and reducing climate-heating emissions. In Jeremy Hunt, the Conservatives appear to have found a brain. In the autumn statement, he pledged to double annual energy efficiency investment with new funding of £6bn.

That is the good news. The bad news is that doubling does not happen until 2025, when the energy bills crisis may well be over and the climate crisis will be even worse. Hunt is the fourth chancellor of 2022 and the chaos in the Tory party has meant unnecessary delays in making people’s homes warmer and cheaper to heat.

The trouble goes back almost a decade in fact, when David Cameron’s ditching of “green crap” resulted in insulation rates falling by 95%, a decision that has cost billpayers billions. Details of the new efficiency plans are yet to be published but will include a new “energy efficiency taskforce”. Its goal will be to reduce the UK’s energy use in buildings and industry by 15% by 2030, a fairly modest ambition.

On the supply of low-carbon energy, Hunt backed expensive nuclear power as well as offshore wind, but said nothing on the fastest and by far the cheapest sources – onshore wind and solar. With blocks on the latter, the Tories continue to be wildly out of tune with voters.

Hunt increased the windfall tax on soaring oil and gas profits from 25% to 35%, making the total tax rate 75%. That may look high, but remember that the oil and gas belongs to the nation – you and me – not the fossil fuel companies, and other nations like Norway have higher rates. A windfall tax on electricity producers of 45%, including wind, solar and nuclear, was also announced by Hunt. Depending on how that is implemented, the green energy companies could end up being taxed more than the fossil fuel producers. That would be mad when green energy is the solution to the energy and climate crisis, and while oil and gas firms can get 91% tax rebates by investing in more oil and gas.

Electric car sales are in the fast lane and Hunt announced that from 2025 owners will need to start paying vehicle excise duty, also known as road tax. That is a disincentive to go electric but by that date electric cars will not only be cheaper to run, as they already are, but also very probably cheaper to buy than petrol or diesel models.

On climate change, Hunt said: “With the existential vulnerability we face, now would be the wrong time to step back from our international climate responsibilities. So I can confirm that, despite the economic pressures, we remain fully committed to the historic Glasgow climate pact agreed at Cop26, including a 68% reduction in our own emissions by 2030.” The government is not currently on track to meet this target.

The autumn statement’s purpose was to find £55bn in tax rises and spending cuts to stabilise the UK economy. To put that in context, that’s about 18 days’ worth of the pure profit the global oil and gas industry has been banking for the last 50 years.

The OBR has slashed its forecast for business investment, which will further damage hopes of lifting UK productivity.

Business investment (spending on, say, a new factory or hi-tech equipment) is expected to shrink by more than GDP during next year’s recession.

Investment recovers in the later years of the forecast but remains 8.8% below the OBR’s March forecast by the start of 2027.

Businesses will be more reluctant to invest and expand in a recession, while higher interest rates will raise the long-run cost of capital. Firms also face spending more on energy, leaving less cash for investment.

I think I say this at every OBR forecast but this remains one of the grimmest charts for the future of the UK economy. And it’s getting worse. Capital is one of the core tenets from PM Mais lecture which CX echoed today yet limited efforts to address this fundamental problem pic.twitter.com/XAe71MuvsR

— Raoul Ruparel (@RaoulRuparel) November 17, 2022

Tories have forced economy into ‘doom loop’, Labour’s Rachel Reeves tells MPs

Rachel Reeves, the shadow chancellor, told MPs that the Tories had put the economy into a “doom loop” in her speech responding to Jeremy Hunt. She said:

Nobody doubts that the Covid pandemic and the war in Ukraine have had profound implications and the whole house is united in its condemnation of Russia’s aggression.

But Britain’s problems started before the Covid pandemic and they started before Russia’s illegal invasion of Ukraine. The UK has grown by an average of 1.4% a year under the Conservatives compared to 2.1% a year in the Labour years before that.

We are the only G7 economy that is still poorer than before the pandemic.

The chancellor is saying today he will be honest, so let’s be honest: no one was talking about cuts to public spending two months ago and no other advanced economy is cutting spending or increasing taxes on working people as they head into recession.

This government has forced our economy into a doom loop where low growth leads to higher taxes, lower investments and squeezed wages, with the running down of public services – all of which hits economic growth again.

She joked that police around Westminster were warning people about pickpockets. Pickpockets managed to trick people by appearing to be friendly, the police say. Reeves went on:

In the last hour, the Conservatives have picked the pockets and purses and wallets of the entire country as the chancellor has deployed a raft of stealth taxes taking billions of pounds from ordinary working people. A Conservative double whammy that sees frozen tax thresholds and double-digit inflation erode the real value of people’s wages. Just one of those freezes, in the personal allowance, will cost an average earner more than £600.

She also said the Tories were treating people like fools by claiming not to be responsible for the events of the past 12 years.

The chancellor and prime minister are trying to convince us that Britain faces problems that are nothing to do with them, that the mini-budget – which imposed a Tory mortgage premium, put pensions in peril and trashed our reputation around the world – was all just a bad dream.

It’s their Bobby Ewing strategy. Downing Street as Dallas. Old cast members return as if nothing has happened, with tangled plotlines to keep the audience.

But the truth is it has lost all credibility and everyone knows it is long past time that this series was cancelled.

And the problem for the British people is this: this is not a dream, this is the everyday nightmare of Tory Britain.

The Conservatives would have us believe that they are not responsible for the last 12 years of failure. In doing so they take the British people for fools.

The UK public finances are “more vulnerable to future shocks”, because of the jump in government borrowing costs, the OBR says.

Those higher interest rates also mean the cost of servicing the national debt has doubled:

The rise in interest rates since March means that the cost of servicing that debt doubles in cash terms to over £100bn and jumps as a share of government revenue from under 5% pre-pandemic to 8.5% by 2027-28, leaving the public finances more vulnerable to future shocks. pic.twitter.com/fdaSRXuJc6

— Office for Budget Responsibility (@OBR_UK) November 17, 2022

OBR: national debt will be £400bn higher than expected

The UK national debt is on track to be £400bn higher than forecast in March, the OBR says.

As a result, underlying debt rises to a peak of 98% of GDP in 2025-26, before falling to 97% in the final year of the forecast.

But this still leaves the level of debt £400bn (18% of GDP) higher in 2026-27 than we forecast in March. pic.twitter.com/BKpukx4Pxn

— Office for Budget Responsibility (@OBR_UK) November 17, 2022

Here is the link to the page on the Treasury website with all the autumn statement documents.

Here is the Treasury’s press release explaining its plans.

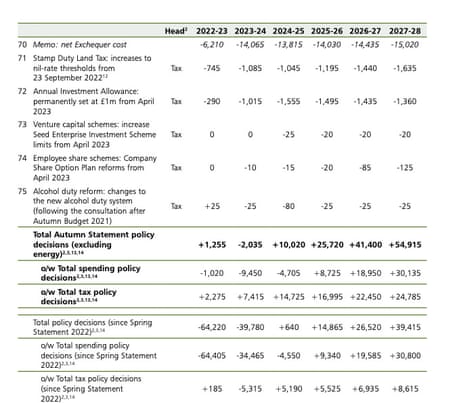

And here is the main autumn statement document. This is the document that includes the scorecard, showing how much each decision costs, or will raise for the Treasury. It starts on page 58 and here is the final page, showing that by 2027-28 the combined effect of the measures in the package is to raise almost £55bn – through higher taxes, or cuts to previous spending plans.

OBR: recession to last just over a year

The OBR predicts that the UK’s recession will last about a year, with GDP falling about 2%.

That’s a relatively shallow recession, and shorter than the Bank of England warned of this month.

But it’s dire enough – and it will mean that the UK economy will not reach its pre-pandemic size until 2024.

That means an entire parliament of lost growth.

Rising prices and interest rates tip the economy into a recession that lasts just over a year, with GDP falling 2% and not returning to its pre-pandemic level until the end of 2024.

At the forecast horizon, GDP is over 3 ppts lower than our March forecast. pic.twitter.com/lg3RRIIZAl

— Office for Budget Responsibility (@OBR_UK) November 17, 2022

In comparison, the US economy reached its pre-pandemic size last summer.

Other G7 nations are also larger than before the pandemic – although some also face the risk of recession.

Can’t blame “global problems” alone…clearly UK specific issues in the response to global challenges, given the UK hasnt grown since Q4 2019, uniquely in G7, since actual Brexit too, and during this Parliament…

UK economy less flexible, responsive, productive.

Supply problems pic.twitter.com/RT5PhXLPtn

— Faisal Islam (@faisalislam) November 11, 2022

OBR: Eight years of living standards growth wiped out in 7% fall

As Hunt sat down, the Office for Budget Responsibility released its latest economic and fiscal outlook.

It’s grim.

The OBR says that despite the new support with energy bills, living standards are going to fall by 7% over the next two years.

That’s a dire outcome, wiping out eight years of growth.

The OBR says:

Over £100bn of additional fiscal support over the next two years cushions the blow of higher energy prices – but the economy still falls into recession and living standards fall 7% over two years, wiping out eight years’ growth.

Over the medium term, around £40bn in tax rises and spending cuts – in roughly equal measure – offsets higher debt interest and welfare costs and gets debt falling as a share of GDP.

The fall in living standards next year will be the biggest on record, so since at least the mid-1950s, the OBR adds:

On a fiscal year basis, RHDI per person (a measure of living standards) falls by 4.3% in 2022-23, which would be the largest since ONS records began in 1956-57.

That is followed by the second largest fall in 2023-24 at 2.8%.

This would be only the third time since 1956-57 that RHDI per person has fallen for two consecutive fiscal years – the last time this happened was in the aftermath of the global financial crisis.

This chart shows the scale of the hit to living standards, as inflation hammers households.

Hunt’s announcement that the pensions triple-lock will be maintained got a good cheer from MPs.

But those relying on the state pension, or welfare benefits, must get through the winter before the 10% rise in payments arrives next April.

Also, those households have struggled with inflation this year, as payments only rose by around 3% this April (based on the previous September’s inflation reading).

Living wage, state pension and benefits will all rise in line with inflation from April.

Recipients still need to get through the winter though. Income this year hasn’t kept pace with prices.— Joel Hills (@ITVJoel) November 17, 2022

Biggest cheer for Hunt committing to fulfilling pension triple lock – with inflation jumping will mean biggest ever increase too

— Ashley Armstrong (@AArmstrong_says) November 17, 2022

Hunt confirms benefits and pensions rising by 10.1% next year, in line with inflation

Hunt ends by confirming that benefits and pensions will rise in line with inflation.

Benefits will go up in line with the inflation rate in September, 10.1%, he says. He says this will cost £11bn, but an average family on universal credit will gain by £600, he says.

Mr Speaker, there have also been some representations to keep the uplift to working age and disability benefits below the level of inflation given the financial constraints we face, but that would not be consistent with our commitments to protect the most vulnerable. So today I also commit to upgrade such benefits by inflation with an increase of 10.1%.

And pensions, and pension credit, will also rise by 10.1%, he says. The triple lock is being protected, he says.

He ends by saying:

This is a balanced plan for stability, a plan for growth and a plan for public services.

It shows that you don’t need to choose either a strong economy or good public services.

With Conservatives, and only with Conservatives, you get both.

National live wage to rise by 9.7% next year, Hunt says

Hunt says he is accepting a recommendation from the Low Pay Commission and increasing the national living wage by 9.7% next year.

That means from April 23, the hourly rate will be £10.42 which represents an annual pay rise worth over £1,600 pounds to a full time worker.